#Monthly budget planner excel how to#

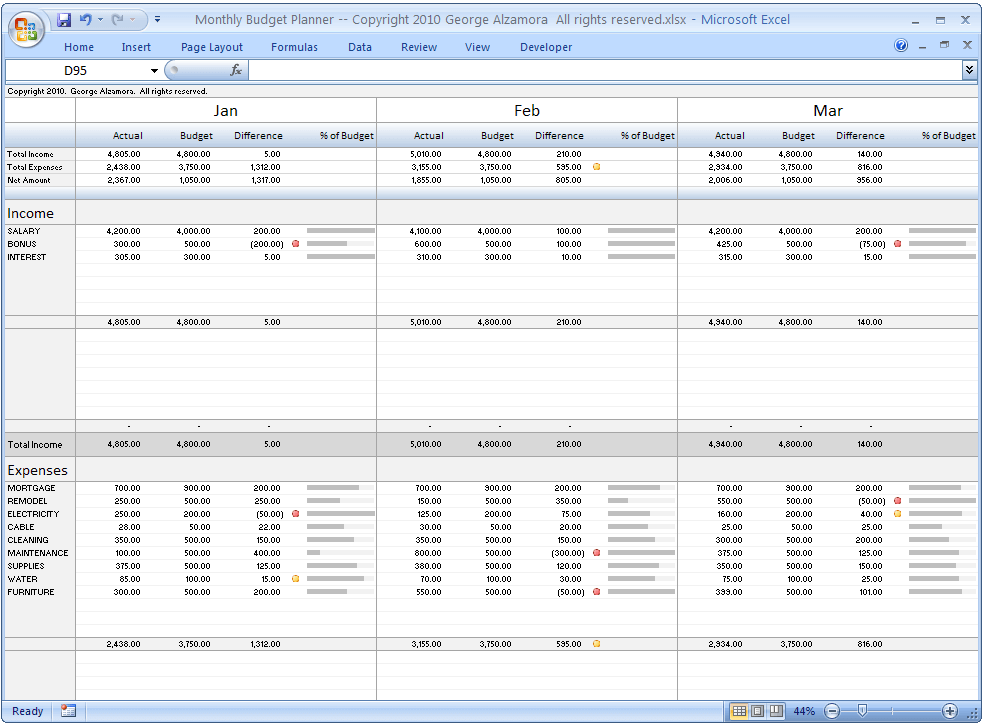

How to Create a Budget Spreadsheetīudget spreadsheets can help an individual track his spending and plan his future expenditure.

For couples, it is important to be open to one another and include what hobbies or crafts you want to spend on. Come up with budget amounts.Īfter the first two steps, it is important to also create a budget for other necessities such as groceries, shopping, or date night. You can also indicate how much of the money left over you will allocate to each of the spending categories. For example, you may want to set a part of it aside for traveling or for an emergency fund. If there is, make a plan of what to do with the remainder instead of spending all of it on random things. Create savings goals.Īfter the total expenditure’s been deducted from the total income, check if there is any money left over. The same process is followed in computing for expenditure. Couples can add up their individual sources of income to come up with the final income amount. A personal budget spreadsheet should be separate from the budget spreadsheet for the household. It depends on the number of sources of your income and if there is anyone else in the house who will help with the expenditure. Put together all sources of income, as well as all expenses. Here, let us learn how to use the budget spreadsheet the easiest way. Some find it effective wherein they are actually able to track their expenditure, while some others don’t, which may be caused by several factors. There are many ways different people use budget spreadsheets. With a budget spreadsheet, money is managed, and every expense is allotted enough amount without exhausting the coffers. It may very well be everyone’s best friend as it is the most helpful tool for organizing one’s finances in order to avoid falling into a debt hole. Too few and you might not be able to properly assess all of the nuances of your financial situation too many and you might end up confusing yourself with access to more than what you actually need.Īs a rule of thumb, useful features for downloadable budget worksheets are the ability to breakdown where your money is being spent and to create your own categories for different expenses.Updated MaWhat is a Personal Budget Spreadsheet?Ī personal budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending over the course of a period of usually a month or a year.

You are going to want to find a worksheet that strikes a good balance between accessibility and the number of features.

#Monthly budget planner excel free#

When assessing a free financial planning worksheet, take the time you need to check out its features. However, when making purchases with credit cards or even via automatic monthly deductions from your bank account, it becomes much more difficult to get that intuitive feeling for how much you’ve spent or can afford to spend. When paying with cash out of pocket, it’s easy to get a feel of how much is being spent. Call Now to See About Lowering Your Debt Payments 80 Choosing a Budget WorksheetĪ well-designed budget planner worksheet will help you decide how you ought to spend your money while avoiding and even reducing debt.

0 kommentar(er)

0 kommentar(er)